Slingshot Expenses app for iPhone and iPad

Developer: Slingshot Software Inc.

First release : 04 Apr 2018

App size: 11.54 Mb

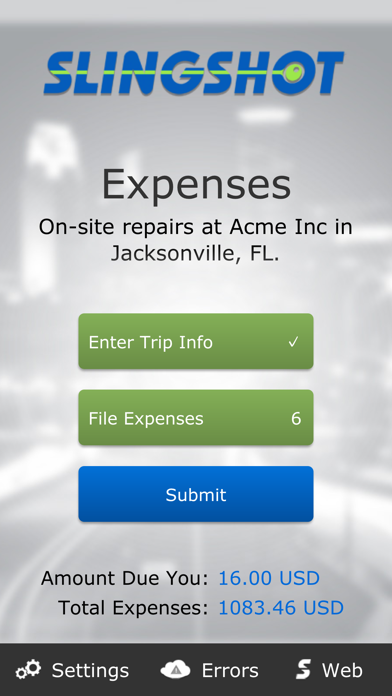

The application allows an employee to capture expenses made on behalf of the company (confirmed by the photos of receipts, taken without leaving the app) and post them to the corporate AP system based on the Slingshot Software Business Suite, thus creating an expense report document. An expense report can also be copied from a travel authorization document (AK "travel request") of the ones that have been entered in the Slingshot G2 web app and have been approved by a corresponding person or role. (In fact, there may be a hierarchy of approvers). The user can (sometimes should) modify the expenses copied from the travel request line items before the expense report submission.

If the user selects a different travel request as a source of the expense report thats been already based on a travel request, the expense report current data is reconciled with the newly selected travel request except the data that have been changed by the user.

The user can file a travel authorization request similarly to the way an expense report is filed, also as a copy of another travel authorization document. The only essential difference is that the expenditure date field can be left blank for an item of a travel authorization request. The currently filed document type (Expense Report or Travel Authorization) can be selected on the Trip Information screen. The default document type is Expense Report.

The receipt image Intelligent Recognition mode is available. The user can just take a picture of a receipt, without leaving the app, as a result if which a new expense record will be created populated with the data extracted from the receipt by a dedicated web service called asynchronously (so the new expense can show the "Pending recognition..." description for a while, normally, for single seconds). If the image is not fully recognized, the user may complete the expense record manually, upon which the app may ask the user to type the name of the merchant, as on the receipt - to help future recognition. (The app will not bother the customer with the latter if the corresponding option is disabled in the app settings).

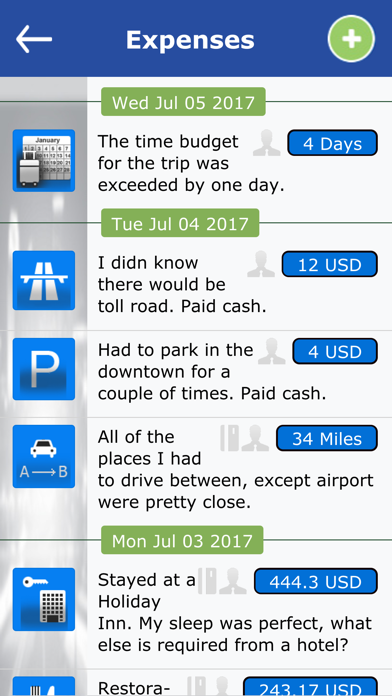

Besides the "regular" expenses paid initially by the employee, then reimbursed to him, supported are also the expenses charged to an employer company credit card (not reimbursed to the employee), the expenses re-billed to a customer, as well as the "rate based" expenses (mileage, per-diem) nominated in non-monetary units (miles, days) reimbursed to the employee at a predefined rate. A distance calculator is available for the Mileage type of expense, based on the assisted entry of the user trip source and destination points.

An expense may also have accounting attributes associated with the expense class GL account variable elements (for which the expense class GL account should be a mask). Examples of such elements are Entity, Division, Cost Center and Job. The user must fill each of the relevant elements from a list of available values (provided by the app server).

Default values for the company card, billed customer and GL account variable elements can be specified at the "global", expense report level. Initially, these defaults are filled from the G2 application global parameters, that may be overridden by the user specific settings, that may be overridden by the source travel request parameters, if a travel request is used.

Entered expense amounts are aggregated in two kinds of totals: Total Expenses and Amount Due You.

The user is required to provide a "trip description" that will become an expense report (document) description when the entered data is uploaded to the server.

When the data has been uploaded, it is wiped out from the device local storage (along with the trip description - if the upload has been fully successful). The default values of expense additional attributes persist though, since there is a high chance that at least some of them will stay the same in the user next report.